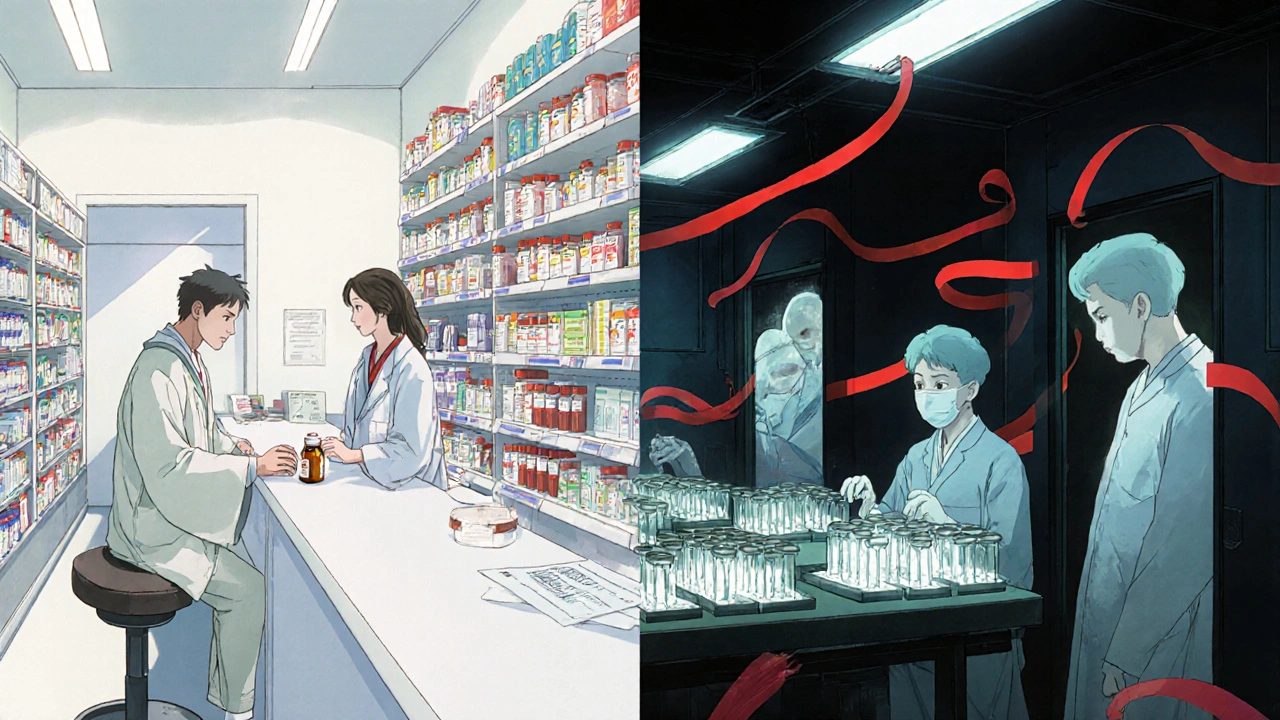

China Makes Most of the World’s Generic Drugs - But Are They Safe?

More than 80% of the active ingredients in generic medicines sold around the world come from China. That’s not a guess - it’s a fact backed by Drug Patent Watch and U.S. FDA data. These ingredients, called APIs (active pharmaceutical ingredients), are the actual drugs in pills like metformin, amoxicillin, and blood pressure meds. You might not know it, but the medicine you take every day likely started in a factory in Shijiazhuang, Zhejiang, or Jiangsu - not in the U.S., Germany, or India.

China’s rise as the global API hub didn’t happen by accident. After joining the WTO in 2001, the government poured billions into building chemical plants, relaxing environmental rules, and subsidizing manufacturers. By 2023, China produced $185 billion worth of pharmaceuticals, with generics making up two-thirds of domestic sales. But here’s the catch: while China makes most of the raw drug material, it exports very few finished pills. Instead, companies in India, the U.S., and Europe buy these APIs and turn them into pills you swallow. That creates a dangerous dependency.

Why Chinese APIs Are So Cheap - And Why That’s a Problem

Chinese manufacturers can produce APIs for $50-$150 per kilogram. In the U.S. or Europe, the same thing costs $200-$400. That’s not magic. It’s cost-cutting. Many Chinese plants still use old, batch-based chemical processes instead of modern continuous manufacturing. They save money by cutting corners on ventilation, waste handling, and lab testing. Some facilities don’t even have proper air filtration systems to prevent cross-contamination.

The FDA has issued over 1,200 warning letters to Chinese drug factories since 2015. The most common problems? Inadequate lab controls (78% of inspections), unvalidated manufacturing processes (65%), and data falsification (52%). In one case, a lab in Zhejiang was caught back-dating test results for metformin. Another plant in Henan reused contaminated equipment between batches. These aren’t rare mistakes - they’re systemic.

And it’s not just about sloppy labs. China’s supply chain is built on speed, not safety. Leading manufacturers like Huahai Pharmaceutical and Sinopharm can churn out 500-2,000 metric tons of a single API per year. That’s enough to supply millions of prescriptions. But when you’re producing that much, quality control becomes a numbers game. One batch might pass. The next might be 10% off potency. And if the test shows it’s bad? Sometimes, the data gets edited - not retested.

The FDA Can’t Keep Up

The U.S. Food and Drug Administration inspects about 200 Chinese drug plants every year. That sounds like a lot - until you realize there are over 1,800 API facilities in China that export to the U.S. That means the FDA inspects less than 10% of them annually. Compare that to the U.S., where domestic plants get inspected every two years on average. In China, some facilities go five or six years between visits.

Former FDA Commissioner Dr. Margaret Hamburg told Congress in 2024: “We’re flying blind in 90% of the places that make the drugs Americans rely on.” Access restrictions, diplomatic tensions, and bureaucratic delays make inspections harder. Sometimes, inspectors are denied entry. Other times, they’re shown clean, prepped sections of the plant - while the real production lines run in the back, unmonitored.

And when problems are found? Penalties are weak. A factory can get a warning letter, fix the obvious issues, and keep shipping. There’s no automatic ban. No financial penalty that hurts profits. Just a paper trail. For many Chinese manufacturers, it’s cheaper to pay for occasional recalls than to upgrade their entire system.

Recalls Are Happening - And They’re Getting Worse

In 2023, Zydus Pharmaceuticals recalled 1.2 million bottles of blood pressure medication because the API from Huahai Pharmaceutical was too weak. Patients weren’t getting enough of the drug. That’s not a minor issue - it’s dangerous. In another case, a batch of generic antibiotics from China had 15% more impurities than allowed. The FDA blocked the shipment, but not before 300,000 doses had already been distributed.

These aren’t isolated events. A 2023 PhRMA survey found that 68% of U.S. generic drugmakers had experienced API quality issues from Chinese suppliers. Forty-two percent reported inconsistent potency. Thirty-seven percent said documentation was falsified. One quality manager on Reddit, who goes by QA_PharmD, said their team had to retest 37% of Chinese-sourced metformin samples - compared to just 8% from Indian suppliers.

And yet, companies keep buying. Why? Because the savings are massive. One procurement officer said switching to Chinese API for amoxicillin saved his company $4.2 million a year - even though 15% of shipments got rejected. For small generic makers, that’s the difference between profit and bankruptcy.

China Is Trying to Fix This - But Is It Enough?

Since 2016, China’s National Medical Products Administration (NMPA) has run the Generic Consistency Evaluation (GCE) program. It requires generics to prove they work the same as the brand-name drug. So far, only 35% of approved generics have passed. That means two-thirds of Chinese generics on the market haven’t been proven to be bioequivalent.

The government has shut down 4,500 non-compliant factories since 2018. The number of generic drugmakers dropped from 7,000 to 2,500. That’s progress. The NMPA now requires electronic submissions, better documentation, and even some continuous manufacturing. By 2026, 30% of high-volume APIs must be made using modern methods.

But here’s the problem: these rules apply to drugs sold in China. They don’t guarantee quality for exports. A factory can pass a Chinese inspection and still fail an FDA audit. The standards are different. Environmental monitoring? Chinese rules say once a week. FDA says every shift. Data retention? China requires 3 years. FDA wants 10. Cultural differences in paperwork mean even well-intentioned factories struggle to comply.

Dr. Liangping Liu of China’s National Institute for Drug Control claims 95% of GMP-certified plants now follow international standards. But independent audits by the WHO and EU regulators tell a different story. In 2023, the FDA found 12.7% of Chinese API samples failed purity tests. For European-made APIs? Just 2.3%. For U.S.-made? 1.8%.

Who Else Is in the Game? India, Vietnam, Mexico

India controls 20% of the global finished generic drug market - but gets 65% of its APIs from China. That’s a fragile link. If China cuts exports, India’s supply chain collapses. That’s why India is investing in its own API plants - but it’s slow. Building a single FDA-compliant facility costs $100 million.

Meanwhile, Vietnam and Mexico are stepping up. Vietnam has over 40 API plants now, mostly focused on antibiotics and painkillers. Mexico is building facilities near the U.S. border to cut shipping time. The European Union’s 2024 Pharmaceutical Strategy wants to cut China’s API share from 80% to 40% by 2030. The U.S. is spending $500 million under the CHIPS Act to bring API production home.

McKinsey predicts China’s market share will drop from 78% in 2023 to 65% by 2030. It won’t disappear - but its dominance won’t be absolute anymore. The question is: will the alternatives be any better?

What This Means for You

If you take a generic drug, you’re probably taking something made in China. You can’t avoid it. Even if your pill is made in the U.S., the active ingredient likely came from a factory in Jiangsu. The FDA doesn’t label the source. Neither do pharmacies.

That doesn’t mean your medicine is unsafe. Many Chinese factories are clean, modern, and compliant. But it does mean you’re trusting a system that’s still inconsistent. If you’re on a life-saving drug - like warfarin, insulin, or epilepsy meds - ask your pharmacist: “Is this generic made with an API from China?” If they don’t know, ask your doctor. You have a right to know.

And if you’re a patient who’s had unexpected side effects or a drug that didn’t work? It might not be your body. It might be the batch. Keep a record. Report it. Your feedback helps regulators spot patterns.

Final Thoughts: Cost vs. Control

China won’t stop making APIs anytime soon. It’s too cheap, too big, and too integrated into the global system. But the days of ignoring quality for price are ending. The U.S. and Europe are waking up. Investors are pulling out of low-compliance Chinese plants. Hospitals are starting to demand audit reports.

The real challenge isn’t just about China. It’s about global supply chains. We outsourced production for profit. Now we’re paying for it in risk. The solution isn’t to ban Chinese drugs. It’s to demand transparency, enforce real standards, and invest in alternatives - before another recall leaves patients in danger.

Are Chinese generic drugs safe to take?

Many are. But not all. Chinese manufacturers produce the majority of the world’s active drug ingredients, and while some facilities meet U.S. and EU standards, others have a history of data falsification, poor lab controls, and contamination. The FDA has issued hundreds of warning letters to Chinese plants. If you’re on a critical medication - like blood thinners, epilepsy drugs, or insulin - talk to your doctor or pharmacist about the source of the API.

Why does the U.S. rely so heavily on China for drug ingredients?

China produces APIs at 30-40% lower cost than Western countries, thanks to state subsidies, lax environmental rules, and a fully integrated chemical supply chain. After China joined the WTO in 2001, it aggressively expanded manufacturing. By 2023, it supplied 78% of the world’s generic APIs. U.S. companies chose cost over control - and now face supply chain risks.

How often does the FDA inspect Chinese drug factories?

The FDA inspects about 200 of China’s 1,800+ API export facilities each year - roughly 10%. Many plants go five or six years between inspections. In contrast, U.S. plants are inspected every two years on average. Access restrictions and diplomatic challenges make inspections harder in China.

What’s the difference between API and finished drug?

The API (active pharmaceutical ingredient) is the actual drug chemical - like metformin or amoxicillin. The finished drug is the pill, capsule, or injection you take, made by combining the API with fillers, coatings, and binders. China makes most of the APIs, but countries like India, the U.S., and Germany turn them into the pills you swallow.

Can I tell if my generic drug uses Chinese ingredients?

No - not easily. U.S. law doesn’t require labeling the origin of APIs. Pharmacies and manufacturers rarely disclose this. Your best bet is to ask your pharmacist or check the manufacturer’s website. Some companies list their API suppliers. If they don’t, you can contact the drugmaker directly.

Is India a better alternative to China for generic drugs?

India makes more finished generic pills than China - but it gets 65% of its APIs from China. So while Indian-made pills may seem safer, they’re still built on Chinese ingredients. India is investing in its own API production, but it’s years behind. For now, India is a middleman, not a true alternative.

What’s being done to fix the problem?

China’s NMPA is pushing for better quality through its Generic Consistency Evaluation program and new tech standards. The U.S. and EU are funding domestic API production. Vietnam and Mexico are expanding capacity. But real change requires more than policy - it needs consistent inspections, real penalties for violations, and transparency from manufacturers.

Conor McNamara

November 18, 2025 AT 17:33Leilani O'Neill

November 19, 2025 AT 16:43Riohlo (Or Rio) Marie

November 20, 2025 AT 03:22steffi walsh

November 21, 2025 AT 04:56Brenda Kuter

November 22, 2025 AT 02:46Shaun Barratt

November 24, 2025 AT 00:14Iska Ede

November 24, 2025 AT 21:18Gabriella Jayne Bosticco

November 26, 2025 AT 06:20Katelyn Sykes

November 27, 2025 AT 21:52Holly Powell

November 28, 2025 AT 01:21Heidi R

November 29, 2025 AT 19:10Sarah Frey

November 29, 2025 AT 22:41Gabe Solack

November 30, 2025 AT 16:18Yash Nair

November 30, 2025 AT 22:13