When you pick up a prescription at the pharmacy, you might not think twice about whether it’s a brand-name drug or a generic. But doctors in different countries see this choice very differently. In some places, generics are the default. In others, they’re still met with hesitation. The truth is, generic medications aren’t just cheaper versions of brand-name drugs-they’re a reflection of how each country balances cost, trust, and access in healthcare.

Europe: Generics as Policy, Not Just Preference

In Germany, France, and the UK, doctors don’t just accept generics-they’re encouraged to prescribe them. Government policies make it easy: pharmacists can swap a brand-name drug for a generic without asking the doctor, and patients pay less out of pocket. It’s not about saving money for the sake of saving-it’s built into the system. European providers see generics as a tool to keep healthcare affordable for everyone, not just a fallback when brands are too expensive. The result? Generics make up 70-80% of all prescriptions across the EU. But here’s the catch: even though they’re used more often, they only account for a small fraction of total drug spending. That’s because brand-name drugs still cost 10 to 20 times more. So while doctors prescribe generics daily, the real financial pressure comes from the high prices of the few remaining patented drugs.North America: High Use, Mixed Trust

In the U.S., generics are everywhere-90% of prescriptions are filled with them. But here’s the paradox: doctors trust them enough to prescribe them, but not always enough to feel confident about their reliability. Drug shortages, especially for injectables and older generics, have shaken that trust. A hospital pharmacist in Ohio might run out of a generic antibiotic one week, then get a new batch from a plant in India the next. No one knows if the quality is the same. Indian manufacturers supply about 40% of U.S. generic drugs. That’s a lot. But when the FDA flags a factory for poor sanitation or inconsistent testing, it sends ripples through the system. Providers start worrying: Is this generic just as safe? Will it work the same? For chronic conditions like high blood pressure or diabetes, even small differences in absorption can matter. So while U.S. doctors prescribe generics because patients can’t afford brands, they’re quietly keeping an eye on the source.Asia-Pacific: Generics as Lifelines

In India and China, generics aren’t just common-they’re essential. For millions of people, there’s no other option. A diabetic in rural India might not have access to insulin branded by a U.S. company. But they can get a generic version for $2 a month, made in a nearby factory. Doctors there don’t debate whether to prescribe generics-they assume it’s the only reasonable choice. This isn’t just about affordability. It’s about scale. India produces 20% of the world’s generic drugs by volume. Chinese factories churn out billions of pills for hypertension, asthma, and cancer treatments. Providers in these countries view generics as infrastructure, like roads or clean water. They’re not alternatives-they’re the foundation. And it’s growing fast. The Asia-Pacific region is expected to grow at over 6% annually through 2034. Why? Aging populations, rising chronic diseases, and governments pushing for universal access. In Thailand or Vietnam, doctors are trained to prescribe generics first. It’s standard practice, not a compromise.

Japan: Price Cuts and Quiet Acceptance

Japan has a unique system: every two years, the government forces drug prices down. Brand-name drugs get slashed. Generics get pushed harder. Doctors used to resist. Now, they’ve adapted. Generics make up more than 80% of prescriptions in Japan, and the trend is only moving one way. What’s interesting is that Japanese providers don’t celebrate generics-they just use them. There’s no big marketing push. No patient education campaigns. It’s just how the system works. The government sets the price. The pharmacy fills the script. The doctor signs off. No drama. No debate. Just efficiency.Emerging Markets: From Last Resort to First Choice

In Brazil, Turkey, and parts of Africa, generics were once seen as a last-resort option-something you took only if you couldn’t afford the real thing. But that’s changing fast. As governments expand public health programs, they’re making generics the standard. In Brazil, a public hospital now stocks only generic antiretrovirals for HIV. In Turkey, doctors are required to prescribe generics unless there’s a clear medical reason not to. This shift isn’t happening because patients asked for it. It’s happening because healthcare budgets are stretched thin. Providers in these countries aren’t choosing generics because they believe they’re better-they’re choosing them because they have no other choice. And over time, that practical necessity is building trust. Patients see results. Doctors see outcomes. Slowly, the stigma fades.

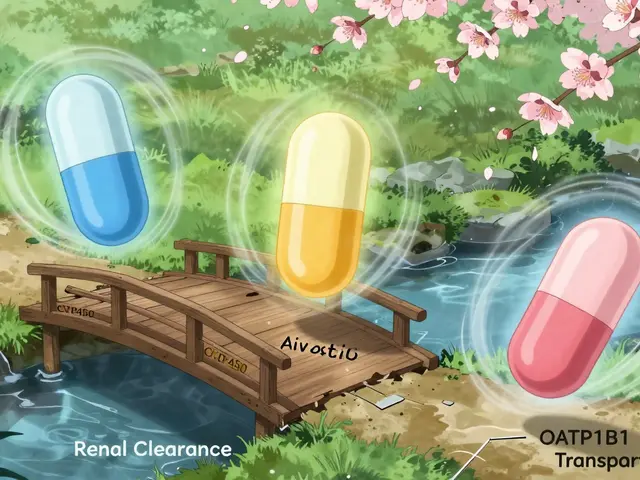

The Rise of Complex Generics

It’s not just pills anymore. Generics are moving into complex areas: inhalers for asthma, injectables for cancer, topical creams for eczema. These aren’t easy to copy. They require advanced manufacturing, precise formulations, and strict quality control. But the market is growing fast. The global specialty generics market is expected to hit $186 billion by 2033. Hospitals are using more of them because they’re cheaper than branded biologics. A generic version of a cancer drug that used to cost $10,000 a month now costs $1,500. That’s life-changing for patients-and for providers who used to have to explain why they couldn’t prescribe the best option. In the U.S., doctors are starting to see complex generics as viable. In Europe, they’re already standard. In India, manufacturers are investing heavily to meet global standards. The message is clear: generics aren’t just for simple antibiotics anymore. They’re becoming part of advanced care.The Big Shift: From Cost-Saver to Care Essential

The biggest change in provider views isn’t about price anymore. It’s about necessity. In 2025, over $200 billion worth of brand-name drugs will lose patent protection. That includes high-cost treatments for cancer, autoimmune diseases, and rare conditions. Generics aren’t just filling gaps anymore-they’re replacing the backbone of modern medicine. Doctors everywhere are realizing: if we want healthcare to be sustainable, we need generics. Not because they’re cheap. Because they’re the only way to keep treatment available to everyone. In the U.S., that means fixing supply chains. In Europe, it means maintaining policy support. In India and China, it means scaling quality control. In emerging markets, it means expanding access. Each region has its own challenge-but the goal is the same: make effective medicine affordable, reliable, and available.What This Means for Patients

If you’re taking a generic drug, your doctor’s view of it depends on where they trained, where they practice, and what their system allows. In some places, they’ll tell you it’s just as good. In others, they’ll say, “I’d prefer the brand, but this is what you can get.” The truth? For most medications-especially for high blood pressure, cholesterol, diabetes, and depression-generics work just as well. The FDA, EMA, and WHO all require them to meet the same standards for safety and effectiveness. The differences are often tiny, and rarely clinically meaningful. But if you’re on a specialty injectable or a complex inhaler, ask questions. Where was it made? Has there been a shortage? Is there a newer version? Don’t assume all generics are the same. Providers in every country are learning that too.Are generic medications really as effective as brand-name drugs?

Yes, for the vast majority of medications, generics are just as effective. Regulatory agencies like the FDA, EMA, and WHO require generics to have the same active ingredient, strength, dosage form, and bioavailability as the brand-name version. Studies consistently show no meaningful difference in outcomes for conditions like high blood pressure, diabetes, or depression. The only exceptions are some complex drugs-like inhalers or injectables-where minor formulation differences can matter. But even then, approved generics meet strict standards.

Why do some doctors still prefer brand-name drugs?

Some doctors stick with brands out of habit, especially if they trained decades ago when generics had more variability. Others worry about supply chain issues-like recent shortages of generic injectables or pills made in factories with quality control problems. In countries with weak regulation, there’s also fear of counterfeit or substandard generics. But in places like Germany, Japan, or India, doctors prescribe generics confidently because the system ensures quality and consistency.

Which countries have the highest generic drug usage?

Germany, Japan, and the UK lead in generic adoption, with over 80% of prescriptions filled with generics. India and China have even higher usage by volume because they produce most of the world’s generics and serve massive populations with limited healthcare budgets. The U.S. leads in volume too-90% of prescriptions-but because brand-name drugs are so expensive, generics only make up about 15-20% of total drug spending.

Are Indian-made generics safe to use?

Yes, if they’re approved by a strict regulatory body like the FDA or EMA. India supplies about 40% of the U.S. generic drug market, and many of its factories meet international standards. The FDA inspects hundreds of Indian facilities each year. Some have been shut down for violations, but most operate safely. The key is whether the specific generic you’re taking has been approved by your country’s health authority-not where it was made.

Why are generic drug prices so different between countries?

It’s all about government pricing policies. In the U.S., drug prices are set by the market-manufacturers charge what they can. In Europe and Japan, governments negotiate prices and force cuts every few years. In India, production costs are lower, and competition is fierce. So a generic pill might cost $0.10 in India, $0.50 in Germany, and $5 in the U.S.-all the same drug, same factory, same quality. The difference is policy, not product.

Will generics replace brand-name drugs completely?

Not completely, but they’ll dominate. As more high-cost drugs lose patents-especially biologics for cancer and autoimmune diseases-generics and biosimilars will take over. By 2030, over $200 billion in annual brand-name sales will be up for grabs. Brands will still exist for truly new innovations, but for most common conditions, generics will be the standard. The future of healthcare isn’t about avoiding generics-it’s about making sure they’re safe, reliable, and accessible everywhere.

laura Drever

January 13, 2026 AT 22:04Generics are fine i guess but who even checks the quality anymore

My cousin got a batch from india that made her sick for weeks

Pharmacies dont even tell you where its from anymore

Trevor Davis

January 14, 2026 AT 16:36Just had a chat with my uncle who’s a pharmacist in Ohio

He says the same generic metformin from the same Indian plant can vary wildly between batches

One month it’s perfect next month patients report weird side effects

It’s not about trust anymore its about luck

Avneet Singh

January 16, 2026 AT 13:19Let’s be real - the entire global generic supply chain is a grotesque oligopoly masquerading as public health infrastructure

India and China aren’t ‘producing medicine’ - they’re commodifying bioavailability under the guise of accessibility

The regulatory arbitrage is staggering and the FDA’s inspections are performative at best

It’s not about cost - it’s about systemic epistemic violence disguised as efficiency

Gregory Parschauer

January 17, 2026 AT 02:49Oh please spare me the ‘generics are just as good’ propaganda

You think the FDA’s ‘bioequivalence’ standards mean anything when the active ingredient is sourced from a factory that got cited for rodent infestations three times last year?

People die because some CEO decided to cut corners on fillers because ‘the patient won’t notice’

And you call that healthcare?

It’s not a cost-saving measure - it’s medical negligence dressed in a white coat

Rosalee Vanness

January 17, 2026 AT 22:11I’ve been on generics for 12 years - blood pressure, cholesterol, antidepressants

Never had an issue

But I get it - if you’ve been burned once by a bad batch, it sticks with you

What I wish more people knew is that the FDA requires generics to hit 80–125% bioequivalence - that’s not a loophole, that’s science

And yes, complex drugs like inhalers? Different story

But for 90% of prescriptions? It’s the same molecule, same effect, same safety profile

Stop treating your meds like lottery tickets

Trust the data, not the fear

lucy cooke

January 18, 2026 AT 00:15It’s not about generics

It’s about the death of care

When your doctor doesn’t have time to explain why you’re getting a pill made in a factory with no nameplate

When your pharmacist swaps it without asking

When your insurance won’t cover the brand

That’s not efficiency

That’s the quiet collapse of the doctor-patient relationship

And we’re all just numbly swallowing the consequences

Milla Masliy

January 19, 2026 AT 02:18As someone raised in Nigeria and now living in Atlanta - I’ve seen both sides

In Lagos, generics were the only option - and we trusted them because there was no alternative

In the U.S., I was told to avoid them because ‘they’re not the same’

Turns out, the same exact pill - same manufacturer, same batch code - was sold in both places

The difference? Price tags and panic

It’s not the drug - it’s the narrative

James Castner

January 19, 2026 AT 09:06The paradigm shift we’re witnessing isn’t merely pharmacological - it is sociopolitical, economic, and epistemological in nature

Generics are not merely cheaper alternatives; they are the structural scaffolding of a healthcare system that has been systematically underfunded, commodified, and dehumanized

The real crisis is not the variability in bioequivalence - it is the normalization of systemic neglect under the banner of fiscal responsibility

When a diabetic in rural Bihar can access insulin for $2/month while a veteran in Ohio waits for a prior authorization on a $1,200 vial - we are not discussing pharmaceutical policy

We are confronting the moral bankruptcy of late-stage capitalism in medicine

And yet - we still call this progress

Trevor Whipple

January 21, 2026 AT 00:24Generics are fine unless you get the one made in that one plant in Hyderabad that got shut down last year

Then you’re screwed

And no one tells you which batch you got

So yeah, i stick with brand

Even if it costs 10x

My life’s not a cost-benefit analysis

Lance Nickie

January 21, 2026 AT 14:04Generics are just as good

Stop being dramatic

Lethabo Phalafala

January 22, 2026 AT 05:44I lost my mom to a bad generic

She was on blood pressure meds

Switched to a new batch

Three weeks later - stroke

They said it was ‘coincidence’

But I know

She didn’t die from high BP

She died because no one cared enough to track where that pill came from

Don’t tell me generics are ‘just as good’

Not until you’ve held the empty pill bottle in your hands and watched someone you love slip away because the system didn’t blink

Damario Brown

January 22, 2026 AT 21:22Let’s be honest - the entire generic drug industry is a regulatory shell game

India makes 40% of U.S. generics

But the FDA inspects like 10% of those plants

And when they do? They give warnings, not shutdowns

Meanwhile, brand-name companies are crying about ‘unfair competition’

But they’re the ones lobbying to keep prices sky-high

It’s not about safety

It’s about profit

And we’re the ones swallowing the consequences - literally